By: Nate Bek and Kirby Winfield

Today, we are excited to announce our investment in AZX, the vertical AI platform for critical infrastructure. We invested in the company’s $6 million pre-Seed alongside AI2 Incubator, SFV, Founders’ Co-op, Kompas, Powerhouse Ventures, and Stepchange Ventures.

Electricity demand is rising as the grid prepares for more than $200 billion in annual investment. Utilities and energy operators are under pressure to adopt AI while maintaining security, reliability, and system integrity. Many have struggled to find partners with both credible AI capability and deep domain experience across energy, utilities, climate, and sustainability.

Concerns around data leakage, system integration, and internal change remain high. As a result, teams are often forced to choose between labor-heavy consultants and rigid SaaS tools that fail to reflect operational reality.

AZX understood this gap early and built a partnership model designed to carry AI from strategy through execution, supported by reusable technologies that accelerate delivery over time.

The company starts with high-touch strategy and bespoke applications, then extracts reusability capabilities into a growing platform to accelerate value. Each engagement strengthens the underlying system and shortens future deployments.

Customers include Puget Sound Energy, CBRE, Trilliant, Franklin Energy, among others. Since last year, revenue is up 10x as demand grows.

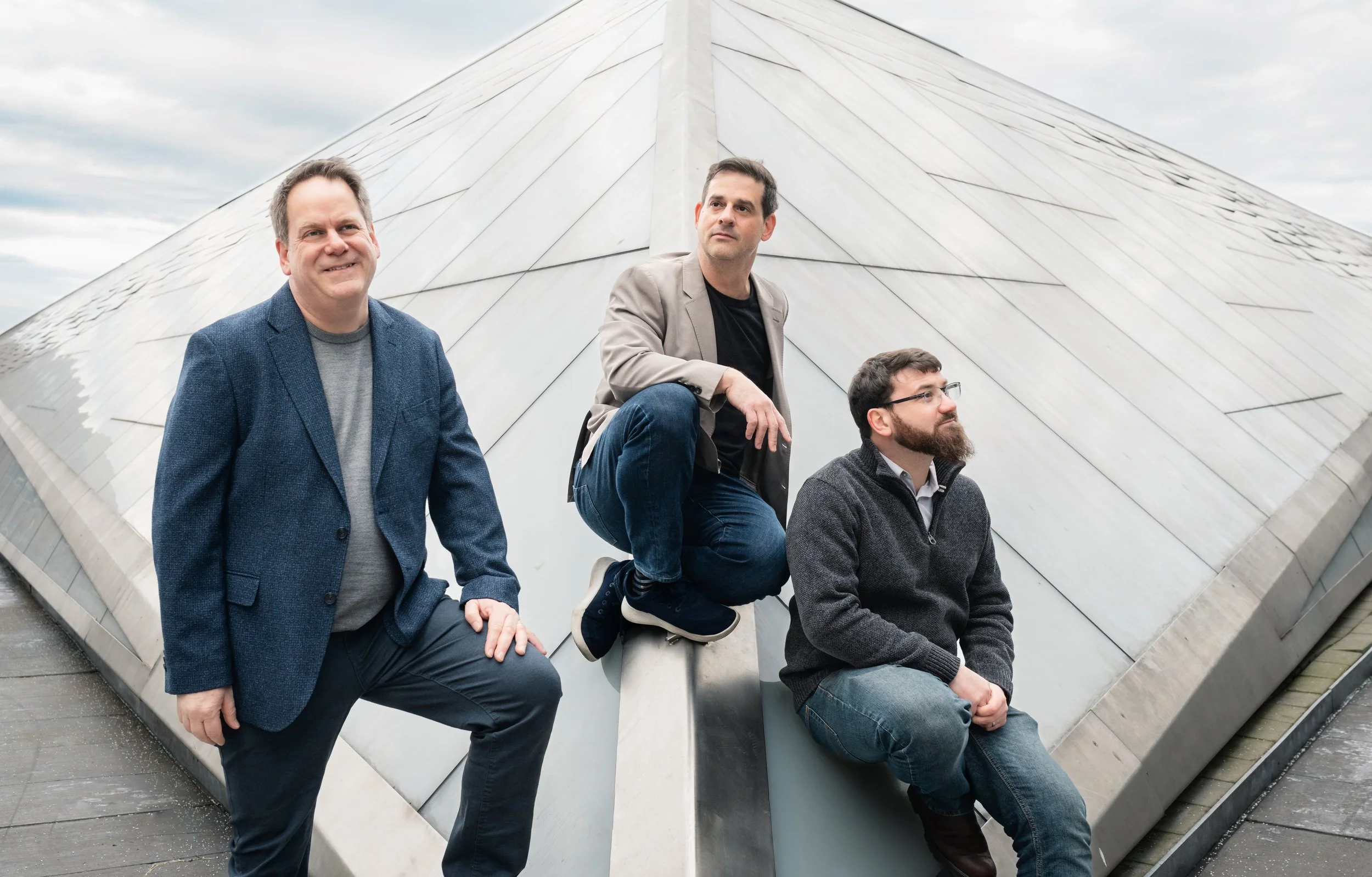

The founding team brings deep experience across energy and software. CEO Aaron Goldfeder is a two-time exited founder with a track record of building and selling into complex environments. We backed Aaron before and have seen firsthand how he operates. He’s joined by long-time collaborators Rich Evans and Michael Albrecht.

AZX, founded in 2024, now employs roughly 20 full-time staff and contractors. The Public Benefit Corporation plans to double this year, with hiring across engineering and operations. Open roles can be found on our Job Board.

AZX occupies a clear middle ground in the market. Large integrators like Accenture move slowly and lack proprietary data models needed for safe AI deployment. Horizontal SaaS platforms struggle with domain specificity and real-world constraints. Platforms such as Palantir offer power but are often priced beyond reach for mid-market and regulated buyers.

We invested because the company brings together the right team, model, and timing to one of the most consequential transitions ahead.

We are proud to back the AZX team.