By: Nate Bek

I met Daniel Paredes on a rainy day in Seattle, at a local staple called Paseo. Over Cuban subs, our conversation pretty quickly veered into deal flow and the exciting open-source and deep-tech projects he’s seeing in Seattle and beyond. It’s clear Daniel is not only a go-getter, but he is also passionate about early-stage, the future of technology, and his hometown Seattle.

“Being from the region, I didn’t have a choice, but it’s hard not to be drawn to Seattle,” said Daniel, an investor at Sierra Ventures, currently based in New York. “The most valuable company in the world is based here, and I truly don’t see any other region outside of San Francisco having as much density in terms of AI talent.”

Daniel graduated from the University of Washington with a degree in finance. After college, he joined Microsoft, where he spent five years in various roles and was most recently a corporate strategy and development manager. Daniel later earned an MBA at Columbia Business School and worked at Madrona Venture Group as an MBA associate.

Sierra Ventures is an early-stage venture firm investing in enterprise and emerging technologies with investments in Seattle. The firm participated in Seattle-based e-commerce startup Fabric’s seed round in 2020, which is also an Ascend VC portfolio company and has gone on to raise over $290M.

Daniel was kind enough to sit down with Ascend for our VC profile series, where we showcase early-stage investor friends from across the US. We talked in more depth about his VC passion, Sierra, and his thoughts about his hometown tech ecosystem. Read to the end for carve-outs.

*We’ve edited this conversation for brevity. Enjoy! — Nate 👾

Nate — What made you decide to be a professional investor?

Daniel — I first learned about venture capital in one of the finance classes at the University of Washington. Ever since then, the seed was planted in my head. Everyone has a different path into VC, but I leveraged my MBA to break into the industry after completing several internships.

What did you do before becoming an investor and how does that benefit your founders?

Prior to making the pivot to VC, I spent five years at Microsoft. At Microsoft, I worked across every product group in finance and strategy roles and spent my last year in corporate strategy, where I helped drive the quarterly and monthly reporting for the CEO and board of directors. Overall, the breadth and learning I received at Microsoft and also through my MBA allow me to support founders in anything from product ideation to financial modeling and more.

Why should founders want you on their cap table?

I’m someone who is going to fight side-by-side with my founders. My entire life and career I’ve played the underdog role, so I know what it means to be scrappy and resourceful.

How many new pitches (actual calls/Zooms) do you take per month?

About 50+. Covering NYC and Seattle is tough, but it’s exciting to get to meet so many founders looking to disrupt so many different industries.

What’s your sweet spot(s) in terms of check size, valuation, and vertical?

We’re currently investing out of our 13th fund ($270 million) and have an early-stage focus on seed and Series A investments. We look at pre-product/pre-rev companies as well. Check size is generally between $1 million to $7 million ($1 million to $3.5 million for seed and $4 million to $6.5 million for Series A). That ramps up to $8 million to $12 million at the strike zone. We also have a preference to lead rounds. We’re geo-agnostic (70% of our deals come outside of the Bay Area) and specialize in enterprise, vertical SaaS and deep tech.

How many new investments do you make per year?

Our goal this year is 12-15 investments.

What initially drew you to the Emerald City?

Being from the region, it was a must for me to focus on scaling up Sierra’s efforts out here, but it’s hard not to be drawn to Seattle in general. The most valuable company in the world is based in Seattle and I truly don’t see any other region outside of SF having as much density in terms of AI talent. The future continues to be bright for Seattle and I’m glad the rest of the world is starting to realize.

How do you stay informed about emerging markets and industries, particularly outside of Silicon Valley?

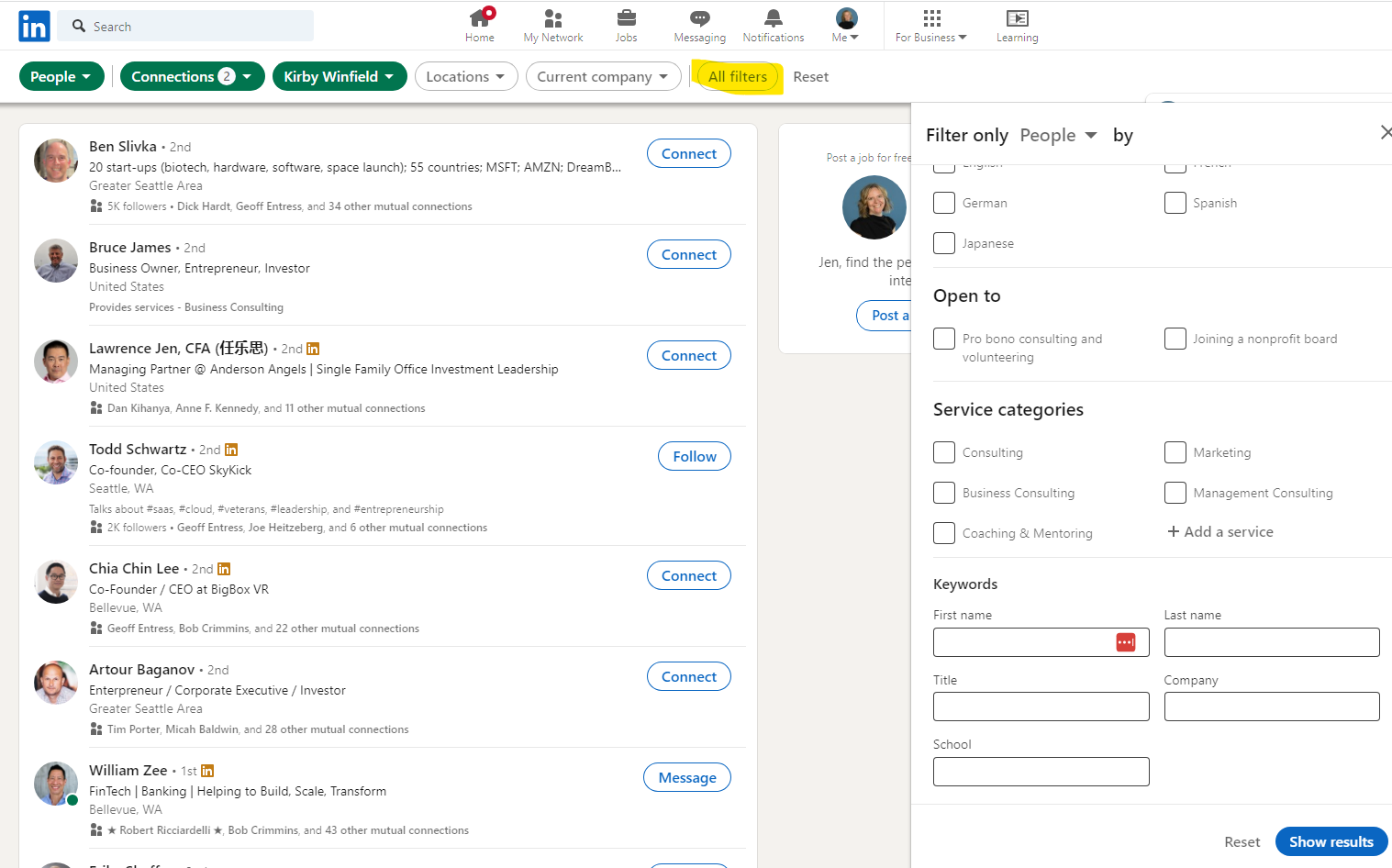

The best way to genuinely stay informed is by doing the dirty work. As much as I’d love to say that I read “X amount of reports or articles,” it really comes down to going out and meeting with people in emerging markets or industries. Another investor described it to me as playing in traffic. My favorite thing about this job is that it allows me to learn from so many talented individuals trying to solve some of the world's biggest problems.

What's your bull case for Seattle/PNW startups? On the flip side, what concerns should the region’s founders and investors keep in mind?

Seattle has some of the most talented and technical founders. What I love is the pure technical talent that I see in founders. On the other hand, I do see technical founders fall short on their GTM strategy, which is driven by customer discovery. Customer discovery is one of the most critical components of company building, as it defines your ICP and guides your GTM as you look to further understand the problem and eventually solve the problem.

What's your take on the key differences in the tech scenes of NYC and Seattle?

Having experienced both ecosystems, it’s hard to compare the two. Seattle thrives on enterprise and solving technical challenges, while New York City brings a variety of industry and founders given the demographic and diversity of industries in NYC. They both are special in different ways and my two favorite cities.

What song is currently getting the most run on your Spotify/Apple Music?

I’m a huge hip-hop head so now that I live in Brooklyn, Jay-Z’s Blueprint album is definitely on repeat. Favorite song off the album would have to be “U Don’t Know.”

Favorite shoes?

The shoe that started it all for me was the Jordan 11. But if I really had to pick, it would probably be the Jordan Bred or Chicago Jordan 1 — you can’t go wrong with a classic.

What's your go-to ingredient in the kitchen, and do you think cooking and investing have anything in common?

My go-to ingredient has to be salt and pepper or caldo de pollo bouillon. I think you need patience for both cooking and investing. Easier said than done — but it’s something I try to practice in both aspects of my life. ☔🔥☔